As a healthcare provider, I’ve worked with patients who use MediShare. After doing some research on the company, I wanted to share a MediShare review based on my experience.

The rising costs of medical insurance premiums and copays is absolutely astonishing to me. It’s not uncommon anymore to see copays of $60 to $80 per visit in my physical therapy clinic. Besides the steep co-pays, patients also have to worry about extremely high monthly premiums for their health insurance plan.

So when I learned about MediShare and how their health sharing plans worked, I was intrigued.

What is MediShare?

MediShare was founded in 1993 by Christian Care Ministry, a non-profit group. Today more than 400,000 Christians use MediShare, making it one of the most popular health-sharing options available today.

How Does MediShare Work?

The concept of health-care sharing is simpler than insurance. Through monthly payments, members pool their money together to cover each other’s health care expenses.

Here’s how it works:

- You go to an in-network Provider and present your MediShare card

- You pay a provider fee (like a co-pay) of $35

- The provider sends the rest of the bill to MediShare, who negotiates the amount

- MediShare shares the outstanding bill with other members

- The members’ pool of funds foots your bill!

MediShare isn’t insurance, there are some new terms to learn. Instead of deductibles and out-of-pocket maximums, medical sharing consists of a monthly share and an annual household portion (AHP).

Monthly Share

This is the amount of money you pay each month, like an insurance premium. Your share contributes to the pool of funds and helps cover other members’ medical expenses.

Health Incentive for Monthly Shares: Generally speaking, healthy individuals dip into the pool of funds less often, and therefore deserve a discount. You might qualify for a reduced monthly payment if you meet certain health standards.

Annual Household Portion

The AHP is the amount of money you pay out of pocket. Similar to an insurance plan’s deductible, you must meet your AHP before outstanding expenses can be “shared” or covered by the pool of funds. It also sets the limit for your household’s maximum out-of-pocket expenses.

Low Monthly Share vs. Low AHP

If you’re familiar with traditional insurance plans, you know that a lower annual deductible typically means a higher monthly premium.

The same is true with the MediShare health-sharing program. Your monthly payments will be higher if you choose a smaller annual household portion. In contrast, the higher your AHP, the lower your monthly share payments.

However, you must meet your AHP before you can start to submit medical expenses to MediShare. Once you meet your AHP, Medishare will cover 100% of your eligible medical bills.

Co-Share

MediShare offers a “co-share” option, similar to co-insurance. Under a co-share plan, members share 70% of their eligible expenses after they reach their AHP. They’ll be able to fully share 100% of expenses after they pay a total of $10,000. This option allows for a lower AHP and an earlier start to expense sharing, and reduces monthly payments by 15-20%.

Sound too good to be true?

There are a few caveats to the program, which I’ll highlight below.

Also, regardless of criteria, MediShare isn’t right for everyone!

Who Can Use MediShare?

As part of a religious ministry group, MediShare is designed for Christians who want an alternative to marketplace health insurance plans.

All members of this health-sharing plan identify as Christ-followers and agree to live by the Biblical standards in MediShare’s Statement of Faith. That includes abstaining from the following activities:

- Use of tobacco or illegal drugs

- Abuse of legal drugs

- Sexual activity outside of traditional Christian marriage

Medical expenses arising from these activities (e.g., injury from a drunk driving accident, pregnancy out of wedlock) will not be eligible for sharing.

MediShare Review: Data Privacy

Another caveat is MediShare’s privacy policy. Because MediShare isn’t insurance, it doesn’t abide by the same rules set for insurance companies. One feature that some may find hard to accept is the sharing of health information.

Members share not only their expenses, but also their previous medical history. You must submit this personal information to join the MediShare program.

However, this sharing serves two purposes: 1) it reveals whether you have any pre-existing conditions and 2) helps MediShare place you in the correct category for monthly payment amounts (standard vs healthy share). Importantly, this information is not shared outside of CCM.

Not Eligible for Dental, Vision, or Hearing Expenses

Finally, MediShare covers only medical expenses, which excludes dental, vision, and hearing expenses. Instead of sharing these costs, members can use MediShare-provided discounts.

How Much Does MediShare Cost?

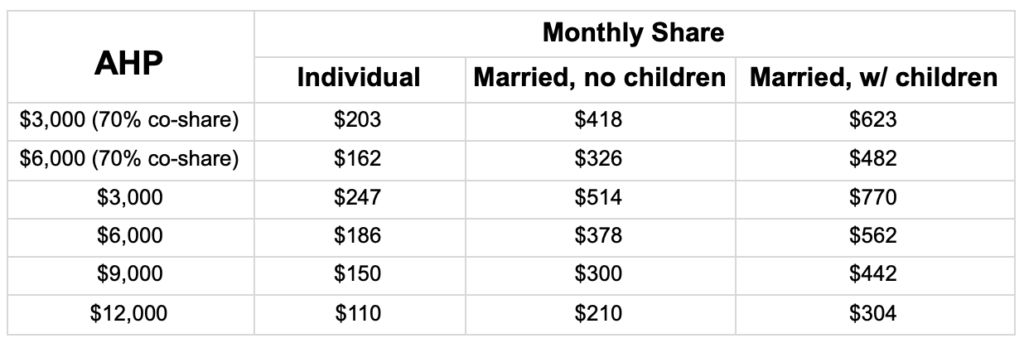

Below is a chart of estimated MediShare fees for Michigan residents:

These amounts are subject to change based on your state, number of children, and other factors. For an accurate quote, contact Medishare directly.

Are there any other fees with MediShare?

Besides your monthly payment, you’ll also need to cover a $2 admin fee. New members are charged a few other fees:

- A one-time non-refundable application fee of $50

- If approved, a one-time new-member fee of $120

- A one-time membership fee of $2

These member fees help cover financial expenses necessary to manage the group funds.

MediShare Review: Provider Fees

Members also pay a $35 provider fee when they visit a physician or are hospitalized. Similarly, emergency room care incurs a $200 provider fee. This co-pay is deducted from the total medical bill, but it does not go towards the Annual Household Portion.

How to Sign Up for MediShare

The team at MediShare makes it easy to apply online or over the phone.

- Visit MediShare website to apply online

- Call MediShare at 800-722-5623 to discuss the options available.

Is MediShare Right For You?

MediShare is not for everyone, but it may be a great solution for Christians looking for an alternative to expensive health insurance plans that don’t meet their needs.

If you’re curious about MediShare and what they have to offer, I’d encourage you to check out their FAQ page. It’s very helpful and answers some very specific questions you may be asking.