When choosing an income driven repayment plan, you’ll need to choose between PAYE, REPAYE, IBR and ICR, which is typically only used for Parent Plus borrowers. That leaves you comparing PAYE vs REPAYE or if IBR (income based repayment) is best for you.

Since PAYE and REPAYE payment plans typically result in lower payments than the IBR option, we’ll focus on these two.

In this article, we’ll help you figure out the main differences between PAYE and REPAYE. The biggest differences we cover in this article focus on:

- Program / Loan Eligibility

- Interest Subsidy

- Maximum payment caps

- Income Considerations & Filing Status

Before we get into these differences, let’s define PAYE and REPAYE.

Difference Between PAYE vs REPAYE

PAYE: Pay as You Earn – An income driven repayment plan for borrowers who took eligible loans during a specific time frame of disbursement. In this program, your payment is capped at 10% of discretionary income and will not exceed the standard 10 year repayment amount as your income increases (an important feature for high-income earners such as physicians). Married borrowers will have the option to exclude spousal income in the calculation of monthly payments if filing separately.

REPAYE: Revised Pay As You Earn – An income driven repayment plan for borrowers who took any type of Direct Loan (excluding parent PLUS loans) regardless of time frame of disbursement. You payment is set at 10% of your discretionary income, but there is no monthly payment cap, so your payment will increase as your income increases. This may result in a payment that is higher than the 10-year standard repayment plan if you are a high-earner. REPAYE also includes an attractive interest subsidy beyond that of the PAYE program. Married borrowers must include spousal income when calculating monthly payment.

What is PAYE? (Pay as You Earn)

PAYE stands for Pay As You Earn and is a PSLF eligible repayment plan that sets your monthly payment equal to 10% of your discretionary income and offers loan forgiveness after 20 years of qualified payments. The problem with PAYE is that it is very restrictive and only certain loans qualify for the program.

Eligibility for PAYE

You must be a new borrower of a Direct Loans as of October 1, 2007 and received a disbursement of a Direct Loan on or after October 1, 2011.

So if you had loans before October 1, 2007 or if you did not get a loan after 2011, you do not qualify for PAYE.

Eligible Loans Include:

- Direct Subsidized and Unsubsidized Loans

- Graduate PLUS loans (made to students only)

- Direct Consolidation Loans

Ineligible Loans:

- Perkins Loan

- FFEL Loans

- Private Loans

Certain loans may be consolidated into a Direct Consolidation Loan and qualify for REPAYE – see below.

Financial Hardship: You must prove financial hardship to qualify. See the payment calculation for PAYE and REPAYE to learn more about qualifying for financial hardship for PAYE eligibility.

Payment Cap: Yes, with PAYE, your monthly payment will be below or equal to 10 year repayment plan. If your calculated payment on the PAYE program is higher than than the standard 10-year repayment plan, you won’t qualify for PAYE because you’re better off with the standard repayment. See below for an example of how to calculate the PAYE or REPAYE payment.

Interest Subsidy: Yes unpaid interest is subsidized by the government for the first three consecutive years. Unsubsidized loan interest is not subsidized at all.

Tax Filing Consideration: Under PAYE married borrowers are able to file separately, which allows them to avoid spousal income in the payment calculation. This may be beneficial for physician couples or for a borrower who is married to a high-earner.

What is REPAYE (Revised Pay as You Earn)

REPAYE stands for Revised Pay As You Earn and is a PSLF eligible repayment plan that sets your monthly payment equal to 10% of your discretionary income and offers loan forgiveness after 20 years of qualified payments (25 years for graduate or professional loans). The REPAYE plan is applicable for Direct Loans including Direct Consolidation loans taken during any time period.

Eligible Loans Include:

- All Direct Loans

- Stafford loans and Graduate Plus loans

- Direct Consolidation Loans

Ineligible Loans:

- Parent Plus Loans

- Consolidated loans with a Parent Plus Loan

- Private Loans

Financial Hardship: No need to prove financial hardship.

Payment Cap: REPAYE does not include a payment cap, which means your calculated monthly payment may exceed the standard 10 year repayment plan if you are a high-earner.

Interest Subsidy (REPAYE): Yes any unpaid interest on Federal Subsidized loan payments is 100% paid by the government for the first three consecutive years and covered at 50% for the remainder of the loan term. Also, 50% of unpaid interest on Unsubsidized Loan payments is paid by the government for the entire term.

Tax Filing Consideration: Under REPAYE married borrowers are not able to exclude their spouse’s income regardless of filing jointly or separately. This may result in a higher monthly payment if your spouse earns a high income.

Calculating PAYE and REPAYE Payment

The PAYE and REPAYE payment calculation is set at 10% of your Discretionary Income which is your Adjusted Gross Income (AGI) minus 150% of the poverty level. The poverty level will vary based on your marital status, number of dependents, and even the state you live in. Use the chart below to find the 150% poverty level figure and subtract it from your AGI. Then multiply this figure by 10% to find your annual payment.

(Adjusted Gross Income – 150% of poverty level) x 10% = annual payment

For example, if you are married without kids and your AGI is 150,000, subtract the 150% poverty level figure of $25,860 (see chart below) and multiply by 10%.

($150,000 – $25,860) x 10% = $12,414

$12,414 / 12 = $1,034.5 monthly payment

150% of the Federal Poverty Level for 2020

| # Persons in Family or Household | 48 Cont. States & D.C. | Alaska | Hawaii |

| 1 | $19,140 | $23,925 | $22,020 |

| 2 | $25,860 | $32,325 | $29,745 |

| 3 | $32,580 | $40,725 | $37,470 |

| 4 | $39,300 | $49,125 | $45,195 |

| 5 | $46,020 | $57,525 | $52,920 |

| 6 | $52,740 | $65,925 | $60,645 |

| 7 | $59,460 | $74,325 | $68,370 |

| 8 | $66,180 | $82,725 | $76,095 |

| 9 or more add this number for each | $6,720 | $8,400 | $7,725 |

PAYE Calculator

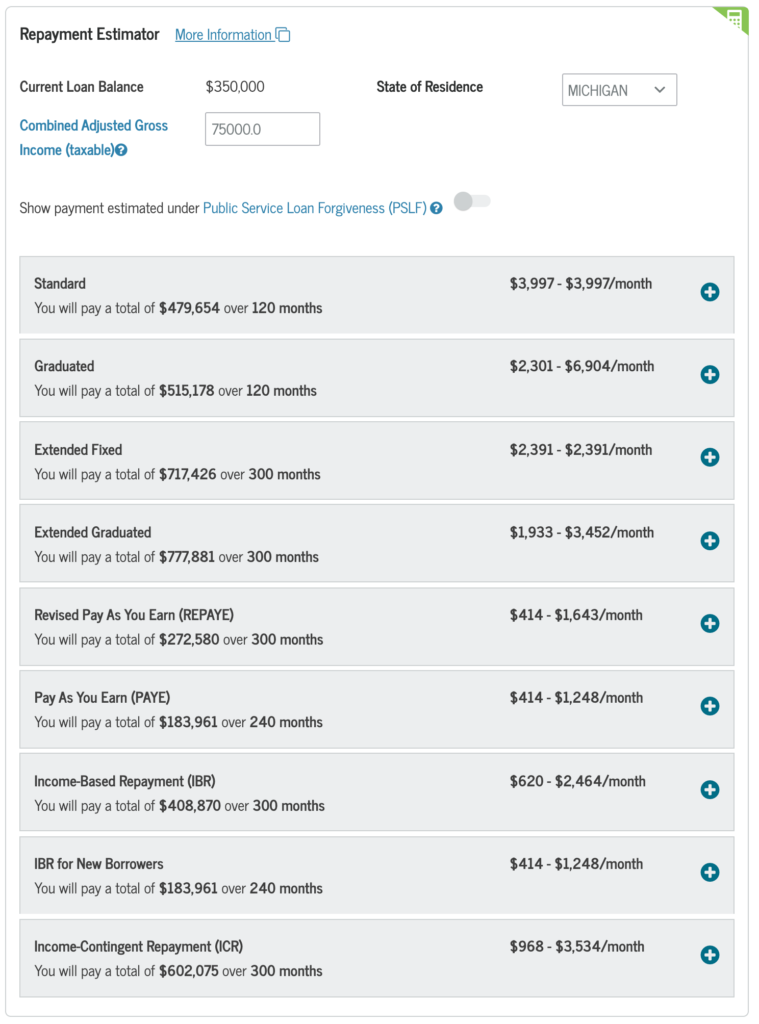

One of the easiest way to see if PAYE or REPAYE makes sense is to use the Federal Student Aide calculator to determine your estimated payments. It’s more than a PAYE calculator, because it actually shows you what your estimated payments would be for other IDR plans based on your income. The calculator takes into consideration your income and your spouse’s income and loans to give you an estimated range of what you can expect your payments to be.

As you can see with this example of a resident physician who has $350,000 with combined income of $75,000 annually, the $414 estimated monthly payment with PAYE or REPAYE is significantly less than the $3,997 per month with 10 year standard repayment plan.

Interest Subsidy for PAYE vs REPAYE

The government will subsidize 100% of the unpaid interest that accumulates on subsidized loans for the first three years of repayment in both the PAYE and REPAYE program. But there are a few differences between REPAYE and PAYE/IBR.

PAYE and IBR Interest Subsidy

With PAYE and IBR plans, the government will pay the interest on your subsidized loans for up to 3 consecutive years if your monthly payment does not cover the interest on your loans. After 3 years, you’re responsible for the interest that accumulates.

The government does not cover any unpaid interest for unsubsidized loans.

REPAYE Interest Subsidy

Similar to PAYE, the government will pay all of the unpaid interest on your subsidized loans for up to 3 consecutive years if your monthly payment does not cover the interest. But one of the biggest differences between PAYE and REPAYE is that after 3 years, the government will cover 50% of the unpaid subsidized loan interest for the remaining term of the loan.

Also with REPAYE, the government will pay half of the unpaid interest on your unsubsidized loans for the full term of your loan (not just the first 3 years).

How Does PAYE and REPAYE Work for PSLF

Under the Public Service Loan Forgiveness (PSLF) program, borrowers may have their federal loans forgiven after 120 qualified payments.

The payments made in the PAYE and REPAYE program are considered qualified payments, which makes it an attractive option for borrowers considering PSLF.

Under the typical PAYE and REPAYE terms, borrowers would have to wait 20-25 years for forgiveness.

But with the PSLF, borrowers can enjoy the lower payments based on their income and experience loan forgiveness after 120 payments (10 years).

PSLF Forgiveness and Taxes

As part of the PSLF program terms, forgiven student loans are not considered taxable income. This is particularly attractive for physicians or other borrowers with high student loan balances because of the option for tax-free loan forgiveness. Using an income driven repayment program like PAYE or REPAYE will keep payments low for as long as possible while providing the borrower with the greatest loan forgiveness benefit.

Choosing Between PAYE vs REPAYE

For most borrowers selecting an income driven repayment option, the eligibility requirements will make the choice of PAYE or REPAYE simple. But for those who do qualify for both PAYE and REPAYE, the choice will be more complicated.

If you do qualify for PAYE and REPAYE, you can use the Federal Student Aide’s calculator to figure out an estimate of your monthly payments compared to all IDR plans. You’ll quickly be able to see which payment plan results in a lower potential monthly payment and even the potential amount forgiven.

When choosing between PAYE and REPAYE, consider these main points:

- Monthly payment amount

- Interest Subsidy

- Maximum payment caps

- Spousal Income Consideration

If you have high student loans and you’re trying to maximize the amount that is forgiven while also balancing the monthly payment and your annual tax burden, it would be worth running multiple scenarios to find your maximal benefit. Using a fee-only advisor who specializes in student loan planning is the best route for figuring out your maximum benefit.

Don’t let the unknown keep you from taking action! Choose one of the options because you can change your IDR plan online later this year – in other words, you’re not locked in forever.

Every year you need to re-certify your existing income-driven repayment plan by providing information about your income and family size.

By logging into studentaid.gov, you can update your income and family information, which may result in a change of your monthly payment.

You’ll also have the option to switch your Income Driven Repayment plan depending on your needs or changes in your income or family status.

What questions do you have about PAYE or REPAYE?