What if I told you that Physical Therapists like you could be leaving thousands of dollars on the table without realizing it?

Besides being a costly oversight, it’s a common mistake among all kinds of healthcare professionals, including those who earn a decent wage. I’m tired of seeing broke PTs, nurses and even physicians make this one mistake and potentially lose thousands of dollars.

What mistake could you be making? Simple: not investing your money early.

Most PTs earn a higher wage than 75% of the entire workforce, but no matter how much you earn today, failing to invest your money now will only make you feel broke later.

Why PTs Are Broke

So what’s the excuse? Why aren’t PTs investing a few hundred dollars each month when the payoff could be so colossal?

Here’s the problem: as PTs, we spend 7-10 years in college racking up debt and making zip. We leave school with hundreds of thousands of dollars in student loan debt with little-to-no finance education from PT school.

And once we finally earn a decent paycheck, it feels like it barely covers the month-to-month expenses worsened by the hefty student loan payments.

Investing Is Still Possible

You may already know about the importance of saving and investing money, but actually prioritizing your investments is a whole different story. Maybe you feel intimidated by investing in general and don’t know where to start.

Not anymore! You don’t have to put off investing until you make “a little more” money or feel more financially free. Instead, you can adapt some new habits and strategies that will help you start investing, regardless of your knowledge or past experience.

And it doesn’t take much to start contributing to a nest egg, whether through your employer’s 401(k) or a personal IRA. For example, saving and investing just $500 a month over 30 years could grow to nearly $750,000 with a modest 8% rate of return.

If you’ve been putting off investing for your future, you can correct this mistake today by following the three strategies I explain below!

Ways to Start Saving and Investing

I have full confidence that, by following these strategies, you could earn an extra $500 a month to save and invest – and get one step closer to a big payoff later on.

1. Get a Side Hustle

If you’re a PT or a nurse, making an extra few hundred dollars is totally possible with the right side hustle. For instance, by working per diem at clinics and nursing facilities one day each weekend, you could easily earn an additional $500 each month.

But outside of the clinic, you can make extra money in other, creative ways. Whether you’re looking for some passive income or lucrative projects, check out the different side hustles I explain in the video below:

While making more money can certainly boost your ability to invest, it isn’t the only way. Sometimes it’s much easier to save $500 than to earn an additional $500, so consider cutting back on your spending – particularly big ticket expenses.

And if you’re a PT or a nurse, your big ticket expenses might include clinical or continuing education.

2. Find Cheap or Discounted CEUs

No one’s saying you need to stop pursuing clinical education in order to save money; I’m not against learning new skills or getting a new certification.

But with so many options to complete CEUs online, it’s easier than ever to cut back continuing education costs, such as travel expenses and time off work. Online CEU providers such as MedBridge Education provide an abundance of continuing education courses you can take at home in your free time.

Instead of spending a couple hundred dollars on one continuing education course, you could save money by using MedBridge. I’ve been doing that for the past few years and have easily saved thousands of dollars on my continuing education – dollars I am now free to invest.

With the Medbridge promo code PTProgress, you can save $150 on a year’s subscription to unlimited continuing education, whether you’re a PT, OT, AT, or even a nurse.

Be it clinical education or something else, my point is that saving money on required expenses doesn’t have to adversely affect your career. In fact, with cheap or discounted CEUs, you can access the latest courses and learn cutting-edge research – without spending the arm and leg you could use elsewhere (e.g., towards your investments!).

Besides generating a little more income through a side hustle or saving a little more on necessary expenses, the third strategy is to better manage your money.

3. Create a Better Financial Plan

An investment is just one part of your financial plan; a budget and a cash flow statement are similarly vital to your financial health. Your cash flow statement will help you track your income and expenses, while your budget (if you stick to it!) can help you stay within your means.

If this is all new to you, don’t worry. A wealth of resources is available online for building a budget and managing cash flow. Your phone’s app store is teeming with helpful budgeting and personal finance apps, such as Mint and You Need A Budget.

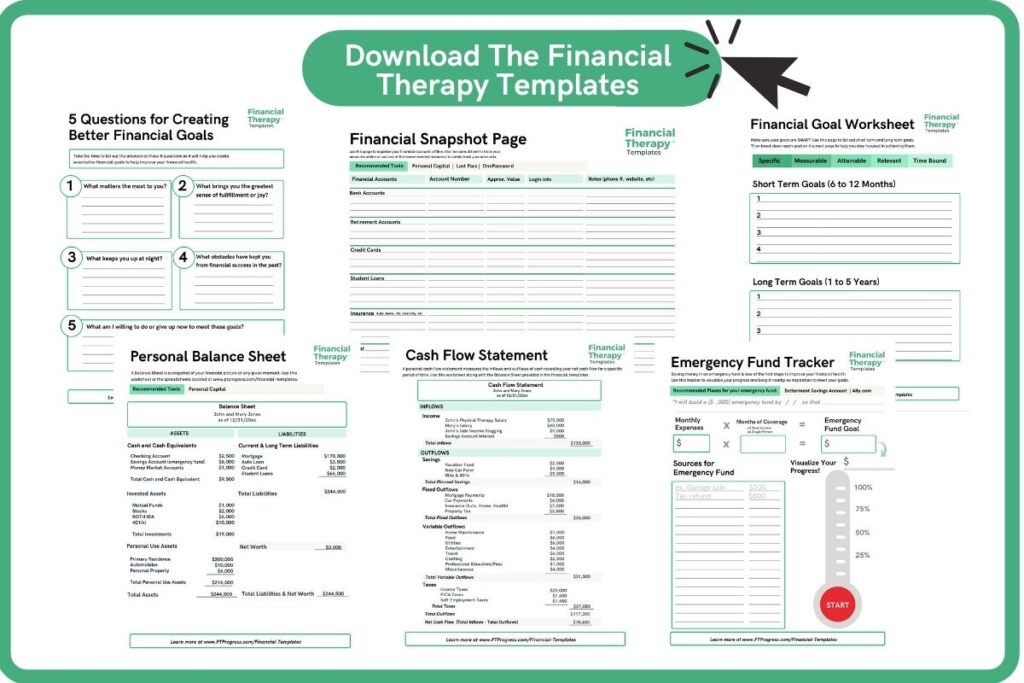

And it doesn’t have to be complicated. Take a look at how I use financial plan templates such as a personal balance sheet to stay organized. You can download this free resource here. I can also walk you through how to use a budget right here on the blog.

Ultimately, until you have a grasp of your basic finances, you won’t be able to make or maintain a plan for the extra money you’ve saved for your investment goals.

Don’t Put It Off!

Look, I know finances are personal and budgets are tight. But in truth, investing a little money now is more than worth the extra effort, sacrifice, or creativity needed. Saving and investing early on is a habit I guarantee you won’t regret.

And don’t forget – you can save $150 on CEUs through MedBridge with the promo code PTProgress.