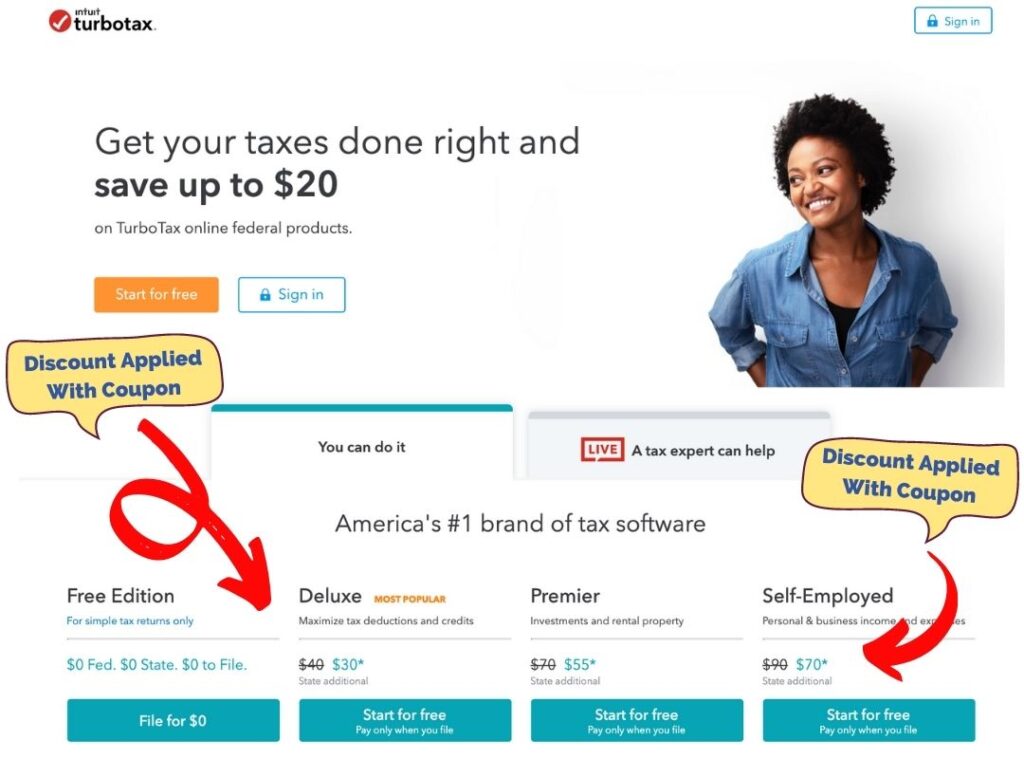

I’ve been using TurboTax for the past 15 years (yes, even as a Certified Financial Planner™) and I still enjoy finding the best discounts for TurboTax each year. You might have noticed an area where you can enter a “TurboTax service code” during checkout. However, you actually don’t need to type in a service code to get their latest deal, where you can save up to 10% on TurboTax with the PTProgress coupon! You just have to make sure you through the right promotion page showing the discount. This is the best TurboTax deal I’ve seen and I’m grateful that TurboTax has made this available to the blog readers!

Biggest savings of the season! Save 10% on TurboTax this year!

If you still want to compare the previous discounts to the latest deals, I’ve organized the top TurboTax service codes, offers, and TurboTax coupon deals into a reference list. Below are the best Turbotax coupons for 2023 and 2024 I’ve been able to find online.

Limited time only. Valid Dates posted on TurboTax above. Offer to save up to an additional 10% on TurboTax is not available everywhere and I am grateful that TurboTax has made this available to my readers!

Table of Contents (Quick View)

- TurboTax Service Codes & Deals for 2022-2023

- TurboTax Discounts – Quick View Table

- Bank of America, AARP, USAA TurboTax Discounts

- TurboTax Product Pricing Information

- What is a TurboTax Service Code?

- Is TurboTax Really Free?

Top 10 TurboTax Service Code for 2024

(from 2022, 2023, and 2024)

1. TurboTax for Military – TurboTax has long offered a discount for the military, however this is no longer a discount that is available . You can still file for free with TurboTax Free Edition*. If you need the premier features, you may be eligible for a discounted rate as well depending on the current promotion. * ~37% of taxpayers qualify. Form 1040 + limited credits only.

2. Student Discount TurboTax – Whether you are a grad student or an undergrad, you can save money on TurboTax or with the other versions using the latest discount. As of now, it’s $15 off depending on the option you select.

3. Costco TurboTax Deal – If you are a member at Costco, you can save money this year when you purchase TurboTax in the store. Combine your purchase with the latest promotional deal from Costco for new members (a $ reward) and apply that towards TurboTax for an even sweeter deal!

4. Uber or Lyft TurboTax Offers – As of now, the $15 off deal is still the highest discount for drivers who want to use TurboTax. For example, if you worked as a ride share provider, you’re best off using the self-employed TurboTax option as you’ll be able to take advantage of certain deductions and credits.

5. AAA Discount on TurboTax – By far the best discount on TurboTax has been AAA over the past few years. However, this will depend on your region. For some reason, however, a higher discount is offered in certain regions only. Even if you don’t qualify for a AAA discount, you can still file for free with TurboTax Free Edition* for simple tax returns only and use the latest discounts. ~37% of taxpayers qualify. Form 1040 + limited credits only.

TurboTax Discount *Update*

TurboTax is running a new promotion that offers $0 Fed. $0 State. $0 to File for simple tax returns. In past years, they have charged between $14.95 and $29.95 to file your state returns. But for 2024, you can file your 1040EZ/A for Federal and State for free with TurboTax Free Edition* for simple tax returns only. I will update this page if an extension is made. * ~37% of taxpayers qualify. Form 1040 + limited credits only.

TurboTax Discount Code 2023

Almost every year you can apply a TurboTax discount code automatically by using the discounted product pages highlighted below. Each TurboTax discount will take off $5 – $15, which can save you up to an additional 10% on average.

6. TurboTax Free Edition: Discount: $ FREE $ You can use the Turbotax Free Edition to file for free* simple tax returns (1040EZ and 1040A). Extra costs may apply for state. ~37% of taxpayers qualify. Form 1040 + limited credits only.

7. Deluxe Edition: – Most popular option for homeowners to maximize tax deductions and credits.

8. Premier Edition: – Best option for people with investments, rental properties, and for those who refinanced their home recently.

9. Self-Employed Edition – Great for independent contractors, freelancers, and business owners. Includes all features of deluxe and premier.

10. TurboTax Canada – To our friends in the north, you can save 10% on TurboTax Canada, too!

TurboTax Service Code 2023 Coupons

TurboTax Service Code?

A TurboTax service code is a special code that provides a discount to TurboTax usually provided by a customer service representative. They are not considered coupons, which can range from $5-15 Off TurboTax as seen here.

TurboTax Service Code 2023

| TurboTax Coupon | Discount Amount | Expiration |

| Military Discount | File for FREE with Turbotax Free Edition* | 4/15/2023 |

| Student Discount | File for simple tax returns only or up to $15 Off | 4/15/2023 |

| Deluxe Edition | $5 off (during TurboTax Promotion period) | 1/20/2023 |

| Premier Edition | $10 off (during TurboTax Coupon period) | 4/15/2023 |

| Self Employed | Up to $15 Off – (during TurboTax Discount period) | 4/15/2023 |

TurboTax Bank of America Discount:

Bank of America has provided discounts for TurboTax in the past, but they no longer provide this discount. However, with the newest $5-15 discount applied from TurboTax, it’s actually a better deal than the old discount from Bank of America.

* Fidelity, USAA, and Progressive Insurance are known to provide discounts for their members. However, the current discounts are usually much better than the smaller 10-15% discount often seen with these companies.

The discounts listed above are based on the latest deals from TurboTax, most updated 01/01/2024. Offers are subject to change and may be discontinued at any given time. I don’t see a BofA TurboTax service code 2023 or 2024 happing this year, but check back to see if that changes.

AARP TurboTax Discount?

AARP TurboTax Discount – As an AARP member, you can get access to hundreds of discounts on services. Many people wonder if there’s a specific AARP TurboTax discount, but they do not offer one as of 2024. But that won’t keep you from getting the best deal when filing your taxes. You can still File for free with TurboTax Free Edition* option for simple tax returns only or save a good percentage with the latest TurboTax service code and promotion.

*~37% of taxpayers qualify. Form 1040 + limited credits only.

USAA TurboTax Discount?

U.S. military members and USAA members can save up to $15 on TurboTax and may be eligible to File for free with TurboTax Free Edition* under the current promotion (TurboTax military discount no longer provided.) While there isn’t a specific USAA Turbotax discount promo code, you can file directly on TurboTax and the discount will apply if you meet the criteria based on their questionnaire. The military / USAA discount should apply before you reach the final checkout page.

Which TurboTax Product Should I Use?

One of the reasons I like to use TurboTax is that it guides you to select the appropriate product based on your needs. For example, if you are a student who needs a basic tax return, you don’t need the Premier version. For someone who owns a house and started a business on the side this year, TurboTax will guide you through the questions that help you decide between the Premier and Self-Employed option.

How much does TurboTax cost in 2023?

TurboTax Plans and Pricing

TurboTax has 5 editions:

- TurboTax Free Edition* (for simple tax returns only)- Cost is $0 + $0 for each state return

- TurboTax Deluxe – Cost is $40 + $40 for each state return

- TurboTax Premier – Cost is $70 + $40 for each state return

- TurboTax Self-Employed – Cost is $90 + $40 for each state return

- TurboTax Live – Cost is additional $50 to $80 per edition plus $50 for state return

*TurboTax Free Edition: ~37% of taxpayers qualify. Form 1040 + limited credits only.

However, a $15 coupon will drop these prices to $54, $79, and $104 for the deluxe, premier, and self-employed options.

Federal TurboTax Free Edition *

Turbotax Free Edition for simple tax returns only – Use the Turbotax free edition for simple tax returns (1040EZ and 1040A). A must for students or new grads.

$0 Fed +$0 State For simple tax returns only with TurboTax Free Edition

Is TurboTax really free? Yes, you can file a simple federal and state tax return with Turbotax for free for simple tax returns only if you have the following situations:

- W-2 income

- Limited interest and dividend income reported on a 1099-INT or 1099-DIV

- Claim the standard deduction

- Earned Income Tax Credit (EIC)

- Child tax credits

*~37% of taxpayers qualify. Form 1040 + limited credits only.

If you have educational expenses or student loan interest to claim, you’ll want to use the deluxe edition for $30.

Turbotax Deluxe Edition

Turbotax Deluxe – Most Popular. This version is great if you own a home or want to deduct your charitable donations or student loans.

Use the deluxe edition if you meet these criteria:

- Deduct student loan interest & educational expenses

- Deduct charitable donations

- Mortgage or property tax

In addition, the Deluxe edition will come with all the features of the Turbotax free edition, and searches for over 350 deductions you may qualify for.

If you’re self-employed or own rental properties, you’ll want to use the premier or self-employed option.

Turbotax Premier Edition

Turbotax Premier Edition – This version includes everything from the Deluxe and is great for those with investments, rental properties, and for those who refinanced their home recently.

You’ll want to consider the Turbotax premier option if you meet the following criteria:

- Own stocks/bonds within an investment account

- You have rental property income

- You’ve refinanced your home this past year

- Reporting gains/losses of cryptocurrency on taxes

Some investment firms can connect directly to TurboTax to allow easy transfer of your tax forms – super helpful if you choose this package.

Turbotax Self-Employed Edition

Self-Employed – As it sounds, this version is for people who are independent contractors, freelancers, and business owners. This version helps you in deducting mileage, home office, and business expenses.

You’ll want to consider the Turbotax self-employed option if you meet the following criteria:

- You need to file a Schedule C,

- Import expenses and vehicle mileage from Quickbooks,

- Need to report 1099-MISC income

TurboTax Live

This newest product from TurboTax provides you with a one-on-one review of your taxes with a tax expert. It includes the 100% accuracy guarantee.

Each version of Turbotax can include the TurboTax Live feature, connecting you with a tax expert for unlimited guidance to answer questions you have.

In addition, the Turbotax Live option provides you with year-round guidance, so you can connect with a tax professional anytime, a really nice feature.

Turbotax Live Pricing

You will pay a premium for this feature, ranging from an additional $50 to $80 depending on the plan you choose.

For a small business owner who is trying to save money but also values the expertise of a tax expert, it’s a surprisingly affordable option to know a tax expert is reviewing your tax return! Most accountants and tax lawyers won’t answer the phone for less than $150!

TurboTax Coupon vs TurboTax Service Code 2024

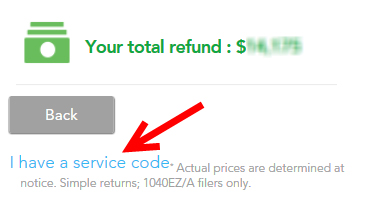

The coupon below is simple because the discount is applied directly through the link.

TurboTax has set up specific pages where the coupons automatically apply. Most discounts are automatically applied when you click on a link or coupon similar to this one:

What is a TurboTax Service Code?

A TurboTax service code applies a discount to your TurboTax product. Sometimes employers provide service codes for TurboTax. You may also get a TurboTax code from a company like AAA or USAA. You can add the TurboTax code directly in your cart when you select the product. The following $15 coupon is the best discount provided.

Enter your service code and click “continue”

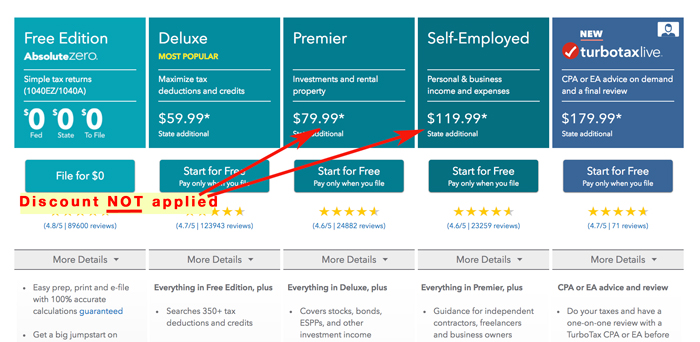

Why isn’t my TurboTax Service Code or Discount Working?

Sometimes the big-name coupon sites will list out multiple ‘coupons’ but none of them actually lead to a page.

Other times, you may be trying to access a TurboTax landing page through a specific offer, but cannot see the page because you are already logged in.

Even still, I recommend logging out of your current page with TurboTax and referring back to the discount page that you are trying to reference.

For example:

- Log out of your account.

- Click on the desired TurboTax coupon link on our site

- View the new page with updated discount:

Tax Deadline 2024

My best advice for those looking to file their taxes is to begin the process early. Most importantly, remember that the tax deadline is Monday April 15th, 2024 this year! The good news, however, is that you can and should start your return now.

Using the $5-15 Off Coupons, head over to TurboTax and sign in while the discount applies. You’ll be able to add your tax information as it arrives and the discount should still apply!

Frequently Asked Questions

TurboTax Service Code 2024 Reddit

In 2018 a user on Reddit posted how they were able to get a Turbotax service code of $20 because they complained about a price discrepancy. Through April 15, 2023, a $5 to $15 discount can be applied to all TurboTax products. If this is extended, I’ll make a note here.

Is Turbotax Really Free

Yes, you can file a simple federal and state tax return with Turbotax Free Edition for free* for simple tax returns only if you only have the following situations: W-2 income only, limited interest and dividend income reported on a 1099-INT or 1099-DIV , you claim the standard deduction, Earned Income Tax Credit (EIC) – Child tax credits. Additionally, if you have educational expenses or student loan interest to claim, you’ll want to use the deluxe edition.

*~37% of taxpayers qualify. Form 1040 + limited credits only.

Happy tax filing!