Recovering from a financial injury is similar to recovering from a sprained ankle. Both processes require a thorough assessment of the situation, a plan for rehab, and exercises to progress through the different stages of recovery.

Sure, you can limp around for a while, ignoring the effects of credit card debt, student loans, and paychecks that are as tight as your hamstrings. But just like in physical therapy, you won’t see a difference in your finances unless you work on a few exercises.

Here are a few financial exercises to help you recover faster.

1. Put Some Ice On It with a Spending Freeze

Don’t skip over this step. Before you take a closer look at the other exercises, try committing to a spending freeze for at least 3 days.

You might be tempted to jump to a 30-day spending freeze, but I want you to get a small win first. By freezing your spending, you’ll be able to step back and see what is actually going on with your money each month.

This is more of a mental exercise than anything because it’s so easy to get into a habit of mindless spending. It’s way too easy to press “Add to Cart” and, 2 days later, get a box. Then another box. Until your room is full of Amazon prime boxes and your credit card is reaching all-time highs.

So, try freezing your spending for one day to start, and then for 3 days, and when you’re up for the challenge, go for a week without buying anything. You’ll survive, and “what doesn’t kill you” will help you break the habit of spending.

2. Feel the Burn – Use cash

Know what hurts more than foam-rolling your IT band? Handing over cold, hard cash to pay for things. A research study found that people spend up to 100% more when they pay by credit card instead of by cash.

One of the reasons for this is a concept called “coupling.” When buying an item with cash, we watch our money leave our hands and experience what can often feel like a painful stimulus.

However, when purchasing things by credit card, we let time pass between the purchase and the payment, an interval that numbs the pain we would normally feel from using cash.

I get it – using cash is inconvenient. You have to plan ahead, go to the bank, track your spending, and maybe even keep the money in separate envelopes. But most exercises are inconvenient; they take effort and are not meant to be fun. Financial exercises are no different.

If you want to see a change in your finances, you need to make a change, and using cash instead of credit is one of the best exercises you can do in the short term.

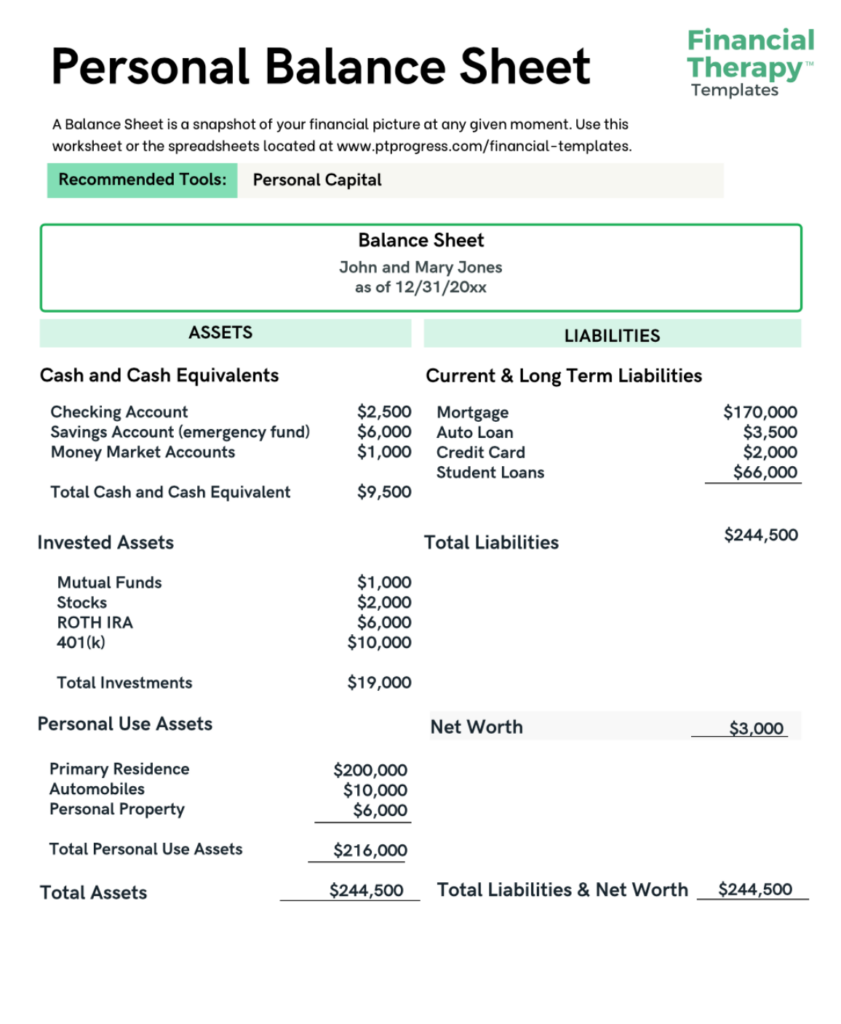

3. Create A Family Balance Sheet

This financial exercise is part of the overall assessment necessary for successful financial rehab. Using a balance sheet gives you a snapshot of your financial picture by identifying your assets (what you own) and your liabilities (what you owe). At the bottom of the sheet you’ll follow a simple equation: Assets minus Liabilities equals Net Worth, the best metric for building and tracking your wealth.

If your net worth is negative, you’re not alone. Over 30 million American families have a negative net worth, according to this Federal Reserve finding.

While it may feel depressing to see a low net worth, making a balance sheet is a necessary antidote. It will help you identify where you stand without running away from the truth (especially if you have the financial equivalent of a broken ankle).

Once you have identified your current financial position, you can make smarter financial goals. If you want an example of a balance sheet and a template to follow, you can download it here, along with 3 other helpful worksheets to get your finances back in shape.

4. Read a Financial Book This Year

The final home exercise for rehabilitating your financial health is to start reading a financial book this year. Regardless of whether you read a physical book or prefer an audiobook, the point of this exercise is to expand your financial literacy.

As you begin to take control of your finances, learn from the mistakes and experiences of others described in these must-read personal finance books:

- The Millionaire Next Door by Thomas J. Stanley – A fascinating read about how millionaires behave and how you can follow in their footsteps.

- Total Money Makeover by Dave Ramsey – A personal finance classic that will inspire you to crush debt and live with new-found financial freedom.

- Rich Dad Poor Dad by Robert T. Kiyosaki – A story that will motivate you to change your mindset about money and your approach to wealth.

- I Will Teach You To Be Rich by Ramit Sethi – An actionable book that promises quick wins with strategies to automate your financial life.

Any one of these books will be an excellent place to start on your journey to rehabbing your financial situation.

Just like in physical therapy, you won’t see a difference until you start doing your financial exercises; the biggest changes happen over time. So don’t prolong your recovery, and get started with your financial home exercises – doctor’s orders.